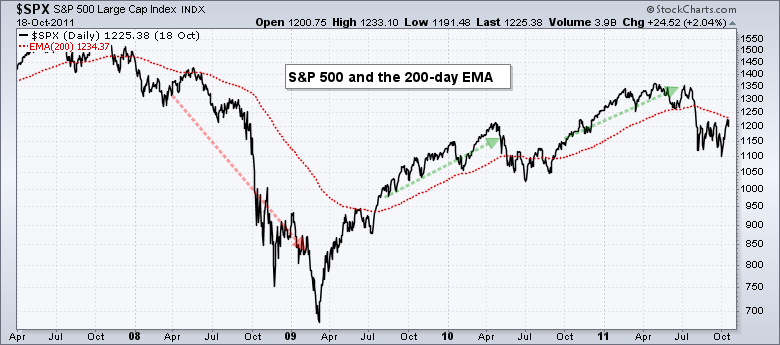

Slopes in the EMA charts signal the uptrend or downtrend of a stock. What is EMA in stocks and how does it work?ĮMAs are essentially used for analysis and as a trading indicator in the stock market. The essential message here is that the exponential moving average can respond faster to changes in the price of an asset. However, the 50-day, 100-day, and 200-day EMAs are commonly used to gauge long-term trends. The 12-day and 26-day EMA are the most popular short-term averages. Unlike a Simple moving average, an exponential moving average responds significantly to the most recent behavior of traders. There are three types of moving averages:Īn exponential moving average, also known as an exponentially weighted moving average places higher weightage on the most recent data points. Moving averages help determine market trends, spot resistance, and support levels. It monitors the average price movement of stock prices over time – calculated from the total of the closing prices of a given period. What is Dematerialization & It's ProcessĪ moving average (MA) is an indicator used in the technical analysis of the stock market.Difference Between Demat and Trading Account.Documents Required to Open a Demat Account.Aims, Objectives and Importance of Demat Account.What is the Sub-broker Program of IIFL?.

0 kommentar(er)

0 kommentar(er)